It’s well known that car insurance companies don’t want you quoting rates from other companies. Drivers who shop for lower rates will presumably move their business because there is a high probability of finding a lower rate. A recent survey found that people who compared prices regularly saved an average of $850 each year compared to policyholders who never shopped around for cheaper prices.

It’s well known that car insurance companies don’t want you quoting rates from other companies. Drivers who shop for lower rates will presumably move their business because there is a high probability of finding a lower rate. A recent survey found that people who compared prices regularly saved an average of $850 each year compared to policyholders who never shopped around for cheaper prices.

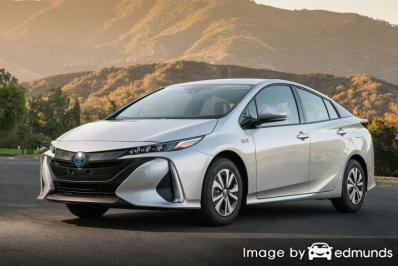

If finding discount rates on Toyota Prius Prime insurance is your target objective, learning the best ways to find and compare car insurance can help simplify the process.

It takes a few minutes, but the best way to get cheaper Toyota Prius Prime insurance is to make a habit of comparing prices annually from insurance carriers in Buffalo.

First, take a few minutes and learn about the coverage provided by your policy and the steps you can take to prevent expensive coverage. Many rating criteria that result in higher rates such as getting speeding tickets and an imperfect credit rating can be amended by making minor changes in your lifestyle. This article gives additional tips to get cheaper coverage and find overlooked discounts.

Second, request rate estimates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only quote rates from a single company like GEICO and Allstate, while independent agents can provide rate quotes from multiple companies. View companies

Third, compare the price quotes to the premium of your current policy to see if a cheaper price is available in Buffalo. If you can save some money, make sure coverage is continuous and does not lapse.

Fourth, provide adequate notice to your current company of your intention to cancel your existing policy and submit a completed application and payment for your new policy. Be sure to keep your new certificate verifying proof of insurance in an easily accessible location.

An important bit of advice to remember is to try to use the same liability limits and deductibles on every quote request and and to get price quotes from every company you can. Doing this enables a fair rate comparison and a complete price analysis.

Keep in mind that comparing a wide range of rates helps increase your odds of locating the best rates.

The companies in the list below are ready to provide quotes in New York. To buy cheaper auto insurance in New York, it’s highly recommended you visit several of them to get the cheapest price.

Three good reasons to insure your Prius Prime

Despite the high insurance cost for a Toyota Prius Prime in Buffalo, insurance may be mandatory for several reasons.

- Most states have minimum mandated liability insurance limits which means it is punishable by state law to not carry specific limits of liability insurance in order to drive the car legally. In New York these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you took out a loan on your vehicle, more than likely the lender will make it a condition of the loan that you buy insurance to guarantee loan repayment. If you default on your policy, the lender may insure your Toyota for a much higher rate and require you to reimburse them for the expensive policy.

- Insurance protects your car and your assets. It also can pay for medical bills for you, any passengers, and anyone injured in an accident. One policy coverage, liability insurance, will also pay to defend you in the event you are sued. If you receive damage to your vehicle caused by a storm or accident, comprehensive (other-than-collision) and collision coverage will cover the repair costs.

The benefits of insuring your Prius Prime more than cancel out the cost, especially when you need to use it. An average driver in America is overpaying more than $869 every year so you should quote and compare rates once a year at a minimum to ensure rates are inline.

Coverages available on your policy

Understanding the coverages of your policy aids in choosing which coverages you need and proper limits and deductibles. Car insurance terms can be ambiguous and coverage can change by endorsement.

Comprehensive (Other than Collision) – This will pay to fix damage from a wide range of events other than collision. A deductible will apply then the remaining damage will be covered by your comprehensive coverage.

Comprehensive insurance covers claims like theft, hitting a deer, damage from a tornado or hurricane, hitting a bird and damage from getting keyed. The highest amount your car insurance company will pay is the market value of your vehicle, so if your deductible is as high as the vehicle’s value it’s not worth carrying full coverage.

Collision coverage – This coverage pays to fix your vehicle from damage resulting from colliding with another vehicle or an object, but not an animal. A deductible applies then your collision coverage will kick in.

Collision coverage protects against claims like colliding with another moving vehicle, sideswiping another vehicle, hitting a parking meter and backing into a parked car. Collision coverage makes up a good portion of your premium, so analyze the benefit of dropping coverage from lower value vehicles. Drivers also have the option to increase the deductible on your Prius Prime to get cheaper collision coverage.

Protection from uninsured/underinsured drivers – This gives you protection from other drivers when they are uninsured or don’t have enough coverage. It can pay for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Since a lot of drivers only purchase the least amount of liability that is required (New York limits are 25/50/10), their limits can quickly be used up. For this reason, having high UM/UIM coverages should not be overlooked.

Medical expense insurance – Coverage for medical payments and/or PIP reimburse you for bills for pain medications, nursing services and rehabilitation expenses. They are often used to cover expenses not covered by your health insurance program or if you are not covered by health insurance. Coverage applies to all vehicle occupants as well as getting struck while a pedestrian. Personal Injury Protection is not available in all states but can be used in place of medical payments coverage

Auto liability insurance – Liability coverage will cover damages or injuries you inflict on a person or their property that is your fault. It consists of three limits, bodily injury per person, bodily injury per accident and property damage. As an example, you may have values of 25/50/10 which means a $25,000 limit per person for injuries, a total of $50,000 of bodily injury coverage per accident, and property damage coverage for $10,000.

Liability coverage pays for things like funeral expenses, loss of income, attorney fees, pain and suffering and court costs. How much liability should you purchase? That is up to you, but you should buy as large an amount as possible. New York requires drivers to carry at least 25/50/10 but you should consider buying more coverage.

The illustration below demonstrates why minimum state limits may not be adequate coverage.

Which auto insurance company is best in Buffalo?

Selecting the right auto insurance provider can be a challenge considering how many choices drivers have in New York. The rank data in the next section could help you decide which coverage providers you want to consider purchasing coverage from.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| The General | 96 | 100 | 92 | 91% | A- | 95 |

| Mercury Insurance | 87 | 96 | 100 | 87% | A+ | 93.4 |

| The Hartford | 88 | 96 | 91 | 93% | A+ | 92.6 |

| Progressive | 84 | 94 | 99 | 90% | A+ | 92.4 |

| Travelers | 84 | 93 | 100 | 87% | A++ | 92.3 |

| State Farm | 84 | 93 | 95 | 87% | A++ | 91 |

| Farmers Insurance | 87 | 92 | 90 | 85% | A | 90.6 |

| Erie Insurance | 92 | 90 | 82 | 88% | A+ | 88.5 |

| Safeco Insurance | 85 | 91 | 87 | 86% | A | 88.4 |

| USAA | 71 | 93 | 98 | 87% | A++ | 88 |

| GEICO | 73 | 93 | 95 | 85% | A++ | 87.1 |

| 21st Century | 85 | 85 | 91 | 89% | A | 86.9 |

| Liberty Mutual | 72 | 91 | 97 | 83% | A | 86.4 |

| AAA Insurance | 85 | 85 | 88 | 86% | A | 85.8 |

| Nationwide | 71 | 90 | 93 | 83% | A+ | 84.9 |

| Allstate | 69 | 92 | 92 | 83% | A+ | 84.4 |

| American Family | 77 | 96 | 80 | 85% | A | 83.8 |

| Esurance | 70 | 80 | 89 | 77% | A+ | 79.2 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies