If you want to save the most money, the best way to find the cheapest price for car insurance rates in Buffalo is to regularly compare price quotes from insurers who provide car insurance in New York.

If you want to save the most money, the best way to find the cheapest price for car insurance rates in Buffalo is to regularly compare price quotes from insurers who provide car insurance in New York.

- Try to understand coverages and the things you can change to prevent high rates. Many things that result in higher rates such as inattentive driving and a low credit score can be eliminated by making small lifestyle or driving habit changes. Read the full article for additional tips to help keep rates affordable and find available discounts that you may qualify for.

- Get rate quotes from exclusive agents, independent agents, and direct providers. Direct companies and exclusive agencies can provide rates from one company like Progressive and State Farm, while agents who are independent can provide price quotes from multiple insurance companies.

- Compare the new rate quotes to the price on your current policy to determine if you can save on Tiburon insurance in Buffalo. If you can save money and buy the policy, ensure coverage does not lapse between policies.

- Notify your agent or company of your intention to cancel your current car insurance policy and submit payment along with a signed and completed policy application to the new company. Immediately upon receiving it, keep the new certificate verifying proof of insurance with the vehicle registration.

A tip to remember is that you’ll want to compare the same liability limits and deductibles on each price quote and and to get price estimates from as many companies as you can. This helps ensure an apples-to-apples comparison and a complete rate analysis.

Shocking but true, almost 70% of drivers have been with the same company for at least four years, and roughly 40% of drivers have never even shopped around for lower-cost coverage. With the average car insurance premium being $1,940, Buffalo drivers could cut their rates by approximately 45% a year by just shopping around, but they just don’t want to find lower-cost insurance by shopping around.

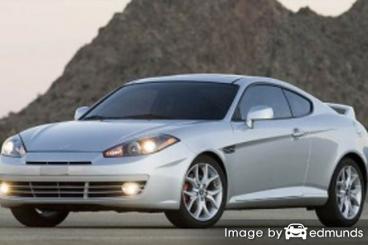

Companies offering Hyundai Tiburon insurance in Buffalo

The following companies offer free quotes in New York. If multiple companies are listed, it’s highly recommended you visit two to three different companies to get a more complete price comparison.

Get lower-cost Hyundai Tiburon insurance in Buffalo with discounts

Not too many consumers would say insurance is affordable, but there may be some discounts that many consumers don’t even know exist. Certain discounts will be triggered automatically at the time you complete a quote, but a few must be specifically requested before being credited.

- Save with More Vehicles Insured – Having primary and secondary vehicles with the same insurance company can reduce rates for all insured vehicles.

- Onboard Data Collection – Drivers who elect to allow driving data collection to look at their driving habits through the use of a telematics system such as Snapshot from Progressive or Drivewise from Allstate might see lower rates if their driving habits are good.

- Defensive Driving Course – Taking part in a driver safety class could save 5% or more if you qualify.

- Theft Deterrent – Cars and trucks with anti-theft systems have a lower chance of being stolen and can earn a small discount on your policy.

- Discount for Passive Restraints – Vehicles with factory air bags and/or automatic seat belt systems may earn rate discounts of 20% or more.

- Smart Student Discounts – A discount for being a good student can earn a discount of 20% or more. This discount can apply up until you turn 25.

- Military Discounts – Being on active deployment in the military could qualify you for better insurance rates.

- One Accident Forgiven – This one is not really a discount per se, but a handful of insurance companies will turn a blind eye to one accident before raising your premiums so long as you are claim-free for a certain period of time.

- No Claims – Insureds with no claims or accidents pay much less in comparison with bad drivers.

- Use Seat Belts – Drivers who require all vehicle occupants to buckle up could save 15% off PIP or medical payments premium.

Just know that most of the big mark downs will not be given to the overall cost of the policy. Most cut the cost of specific coverages such as physical damage coverage or medical payments. So when it seems like having all the discounts means you get insurance for free, companies don’t profit that way. Any amount of discount will definitely reduce your policy premium.

If you would like to choose from a list of companies that offer many of these discounts in New York, follow this link.

Can’t I compare prices from local Buffalo insurance agencies?

Some people still prefer to have an agent’s advice and that can be a great decision Licensed agents can answer important questions and help in the event of a claim. One of the best bonuses of comparing rate quotes online is the fact that you can find cheaper prices but still work with a licensed agent. Putting coverage with local agencies is especially important in Buffalo.

To help locate an agent, after submitting this short form, your insurance data is immediately sent to local insurance agents that give free quotes for your insurance coverage. You won’t even need to even leave your home due to the fact that quote results will go to you. If you wish to compare prices from a specific insurance provider, just jump over to their website and give them your coverage information.

To help locate an agent, after submitting this short form, your insurance data is immediately sent to local insurance agents that give free quotes for your insurance coverage. You won’t even need to even leave your home due to the fact that quote results will go to you. If you wish to compare prices from a specific insurance provider, just jump over to their website and give them your coverage information.

When searching for a local Buffalo insurance agent, it’s important to understand the types of agencies from which to choose. Insurance agents in Buffalo are either independent or exclusive depending on the company they work for. Both can insure your vehicles, but it is important to understand the difference in the companies they write for because it can impact which type of agent you select.

Independent Insurance Agents (or Brokers)

Independent agencies can sell policies from many different companies so they can quote policies with any number of different companies depending on which coverage is best. To move your coverage to a new company, an independent agent can move your coverage which makes it simple for you. When comparing rate quotes, you should always compare quotes from independent agents in order to compare the most rates. A lot of them also have access to small regional insurance companies which could offer lower prices.

The following are Buffalo independent insurance agents that can possibly get you free price quotes.

- Centinello Insurance

1274 Bailey Ave # 1 – Buffalo, NY 14206 – (716) 893-4332 – View Map - P.A.G. Agency Inc

1660 Kensington Ave – Buffalo, NY 14215 – (716) 835-3221 – View Map - Burch Insurance Agency

4180 Bailey Ave – Buffalo, NY 14226 – (716) 830-3417 – View Map

Exclusive Agents

These type of agents normally can only provide a single company’s rates and examples are AAA, State Farm, Farmers Insurance, and Allstate. They generally cannot shop your coverage around so you might not find the best rates. They are usually well trained in insurance sales which helps them sell on service rather than price. Some insured continue to buy from exclusive agents primarily because of the prominent brand name and the convenience of having a single billing for all their coverages.

Listed below are exclusive agencies in Buffalo that can give you price quote information.

- Farmers Insurance – Toni Du Bois

2460 Main St – Buffalo, NY 14214 – (716) 931-5200 – View Map - Marc Scherrer – State Farm Insurance Agent

2165 Sheridan Dr – Buffalo, NY 14223 – (716) 875-0524 – View Map - Progressive Insurance – Buffalo Service Center

6699 Transit Road – Buffalo, NY 14221 – (716) 810-1500 – View Map

Picking the best insurance agency requires you to look at more than just the bottom line cost. Get answers to these questions too.

- Will the quote change when the policy is issued?

- Does the agency have a positive business rating?

- How long has their agency been open in Buffalo?

- Is the agent properly licensed in New York?

- What company do they have the most business with?

- What is the financial rating for the quoted company?

If you feel you receive positive responses to all your questions as well as low cost Hyundai Tiburon insurance quotes, it’s a good possibility that you have found an auto insurance agent that is reputable and can adequately provide insurance.

Car insurance coverage information

Knowing the specifics of auto insurance helps when choosing appropriate coverage at the best deductibles and correct limits. Policy terminology can be difficult to understand and even agents have difficulty translating policy wording.

Insurance for medical payments

Med pay and PIP coverage pay for expenses for things like funeral costs, X-ray expenses, surgery and rehabilitation expenses. They are utilized in addition to your health insurance program or if you are not covered by health insurance. Coverage applies to all vehicle occupants as well as being hit by a car walking across the street. PIP is not available in all states but can be used in place of medical payments coverage

Auto liability

This will cover damage that occurs to other’s property or people in an accident. This insurance protects YOU from claims by other people. It does not cover your injuries or vehicle damage.

Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. As an example, you may have limits of 25/50/10 which stand for $25,000 in coverage for each person’s injuries, a per accident bodily injury limit of $50,000, and a limit of $10,000 paid for damaged property. Some companies may use a combined single limit or CSL which combines the three limits into one amount rather than limiting it on a per person basis.

Liability coverage protects against things such as court costs, medical services, pain and suffering and legal defense fees. How much coverage you buy is a decision to put some thought into, but buy as high a limit as you can afford. New York state minimum liability requirements are 25/50/10 but drivers should carry higher limits.

The chart below demonstrates why low liability limits may not provide you with enough coverage.

Uninsured Motorist or Underinsured Motorist insurance

This protects you and your vehicle when the “other guys” do not carry enough liability coverage. Covered losses include injuries to you and your family and damage to your Hyundai Tiburon.

Due to the fact that many New York drivers only carry the minimum required liability limits (25/50/10), it only takes a small accident to exceed their coverage. This is the reason having UM/UIM coverage is very important. Usually the UM/UIM limits are similar to your liability insurance amounts.

Comprehensive coverage (or Other than Collision)

This pays for damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage protects against things like hail damage, damage from getting keyed, hitting a deer, vandalism and theft. The highest amount a auto insurance company will pay at claim time is the actual cash value, so if the vehicle is not worth much it’s not worth carrying full coverage.

Collision coverage protection

This coverage will pay to fix damage to your Tiburon resulting from colliding with an object or car. You have to pay a deductible and the rest of the damage will be paid by collision coverage.

Collision coverage protects against things such as crashing into a building, sideswiping another vehicle, colliding with a tree and driving through your garage door. Collision coverage makes up a good portion of your premium, so analyze the benefit of dropping coverage from vehicles that are older. Drivers also have the option to raise the deductible on your Tiburon to get cheaper collision coverage.

New York auto insurance company ratings

Picking the best car insurance company is hard considering how many different companies there are to choose from in Buffalo. The company information below may help you choose which auto insurance companies you want to consider comparing price quotes from.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| The General | 96 | 100 | 92 | 91% | A- | 95 |

| Mercury Insurance | 87 | 96 | 100 | 87% | A+ | 93.4 |

| The Hartford | 88 | 96 | 91 | 93% | A+ | 92.6 |

| Progressive | 84 | 94 | 99 | 90% | A+ | 92.4 |

| Travelers | 84 | 93 | 100 | 87% | A++ | 92.3 |

| State Farm | 84 | 93 | 95 | 87% | A++ | 91 |

| Farmers Insurance | 87 | 92 | 90 | 85% | A | 90.6 |

| Erie Insurance | 92 | 90 | 82 | 88% | A+ | 88.5 |

| Safeco Insurance | 85 | 91 | 87 | 86% | A | 88.4 |

| USAA | 71 | 93 | 98 | 87% | A++ | 88 |

| GEICO | 73 | 93 | 95 | 85% | A++ | 87.1 |

| 21st Century | 85 | 85 | 91 | 89% | A | 86.9 |

| Liberty Mutual | 72 | 91 | 97 | 83% | A | 86.4 |

| AAA Insurance | 85 | 85 | 88 | 86% | A | 85.8 |

| Nationwide | 71 | 90 | 93 | 83% | A+ | 84.9 |

| Allstate | 69 | 92 | 92 | 83% | A+ | 84.4 |

| American Family | 77 | 96 | 80 | 85% | A | 83.8 |

| Esurance | 70 | 80 | 89 | 77% | A+ | 79.2 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies

More effort can pay off

Affordable Hyundai Tiburon insurance in Buffalo is attainable on the web in addition to many Buffalo insurance agents, and you need to comparison shop both to have the best selection. Some insurance companies do not provide rate quotes online and usually these small insurance companies sell through local independent agencies.

When searching for affordable Buffalo car insurance quotes, do not reduce needed coverages to save money. There are many occasions where someone dropped uninsured motorist or liability limits only to regret that they should have had better coverage. The aim is to purchase plenty of coverage at the best possible price, not the least amount of coverage.

Consumers who switch companies do it for many reasons like not issuing a premium refund, high rates after DUI convictions, policy non-renewal and even questionable increases in premium. It doesn’t matter why you want to switch switching insurance companies can be less work than you think.

For more information, feel free to visit the resources below:

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- How Much is Buffalo Auto Insurance for Safe Drivers? (FAQ)

- How Much is Auto Insurance for a Ford Edge in Buffalo? (FAQ)

- Who Has Cheap Auto Insurance for Government Employees in Buffalo? (FAQ)

- How Much is Buffalo Car Insurance for Inexperienced Drivers? (FAQ)

- Child Safety FAQ (iihs.org)

- Auto Crash Statistics (Insurance Information Institute)