It’s shocking but most car insurance buyers have stayed with the same insurance company for well over three years, and just short of a majority have never shopped around. With the average car insurance premium being $1,940, New York drivers could cut their rates by up to $840 a year by just comparing quotes, but they just don’t understand the large savings they would see if they moved their coverage to a different company.

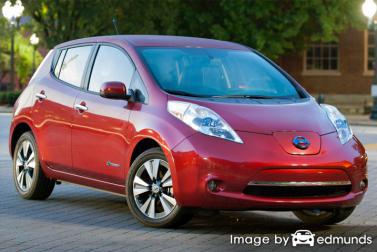

If you want to save the most money, the best way to get the cheapest Nissan Leaf insurance in Buffalo is to do a yearly price comparison from providers in New York.

If you want to save the most money, the best way to get the cheapest Nissan Leaf insurance in Buffalo is to do a yearly price comparison from providers in New York.

Step 1: Learn about the coverage provided by your policy and the changes you can make to lower rates. Many policy risk factors that result in higher prices like at-fault accidents, careless driving, and a negative credit score can be improved by making minor driving habit or lifestyle changes. Keep reading for information to get low prices and get discounts that may be overlooked.

Step 2: Compare rates from direct, independent, and exclusive agents. Exclusive agents and direct companies can only provide price estimates from a single company like GEICO or Farmers Insurance, while agents who are independent can give you price quotes for many different companies.

Step 3: Compare the new quotes to the premium of your current policy to see if a cheaper rate is available in Buffalo. If you can save some money and decide to switch, ensure there is no coverage lapse between policies.

Step 4: Give notification to your agent or company of your intention to cancel your current auto insurance policy. Submit payment along with a signed and completed policy application to the new company. Once coverage is bound, place your new certificate verifying proof of insurance along with the vehicle’s registration papers.

One bit of advice is to use identical coverages on each quote request and and to get price quotes from as many companies as you can. Doing this ensures a fair price comparison and a complete selection of prices.

Finding the cheapest coverage in Buffalo is actually very simple if you learn how to start. Just about every car owner who compares rates for auto insurance will more than likely be able to find better rates. Although New York vehicle owners can benefit by having an understanding of how companies calculate their prices because rates fluctuate considerably.

The cheapest Buffalo Nissan Leaf insurance

Keep in mind that quoting more will increase your chances of finding lower pricing.

The car insurance companies shown below provide price comparisons in Buffalo, NY. If you want cheap car insurance in Buffalo, we suggest you visit several of them to get a more complete price comparison.

Why you need quality insurance for your Nissan Leaf

Despite the high cost, maintaining insurance is not optional due to several reasons.

- Almost all states have mandatory liability insurance requirements which means state laws require a minimum amount of liability insurance coverage if you want to drive legally. In New York these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If your vehicle has a loan, almost every bank will make it mandatory that you have comprehensive coverage to guarantee loan repayment. If you let the policy lapse, the lender may insure your Nissan at an extremely high rate and require you to fork over much more than you were paying before.

- Insurance safeguards both your assets and your Nissan Leaf. Insurance will pay for hospital and medical expenses for both you and anyone you injure as the result of an accident. One policy coverage, liability insurance, will also pay to defend you if you are sued as the result of an accident. If mother nature or an accident damages your car, your auto insurance policy will pay to restore your vehicle to like-new condition.

The benefits of buying auto insurance outweigh the cost, specifically if you ever have a liability claim. The average driver in New York is overpaying over $750 every year so you should quote your policy with other companies at every policy renewal to save money.

Four Tips to Get Cheaper Buffalo Insurance Premiums

Multiple criteria are part of the equation when you get a price on insurance. Some of the criteria are obvious like a motor vehicle report, although others are not quite as obvious like your vehicle usage or your commute time.

Policy add-ons can waste money – There are many additional extra coverages you can purchase on your Leaf policy. Insurance for things like roadside assistance, accident forgiveness, and membership fees could be just wasting money. These coverages may sound good when deciding what coverages you need, but if you have no use for them think about removing them and cutting costs.

Frequent insurance claims increase premiums – Companies in New York give discounts to policyholders who are claim-free. If you are a frequent claim filer, you can expect either policy cancellation or increased premiums. Your insurance policy is designed for larger claims.

Multi-policy discounts can save money – Some insurers give lower prices to customers who carry more than one policy in the form of a multi-policy discount. Even if you’re getting this discount drivers will still want to compare other Buffalo Leaf insurance rates to help guarantee you have the best rates. It’s possible to still save even more even if you insure with multiple companies

Premiums impacted by vehicle usage – The more you drive your Nissan annually the more you will pay for auto insurance. Almost all companies rate vehicles determined by how the vehicle is used. Cars and trucks that are left in the garage get more affordable rates than those used for commuting. Double check that your auto insurance policy states the correct driver usage. A policy that improperly rates your Leaf may be costing you.

Insurance losses for a Nissan Leaf – Auto insurance companies factor in insurance loss information to help determine the rate you pay. Models that the statistics show to have increased losses will have a higher cost to insure. The data below shows the collected loss data for Nissan Leaf vehicles.

For each policy coverage, the claim probability for all vehicles combined as an average is a value of 100. Numbers under 100 suggest a positive loss record, while percentages above 100 point to more losses or a tendency for losses to be larger than average.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Save a ton by taking advantage of discounts

Some companies don’t always publicize every discount they offer in an easy-to-find place, so the following is a list of some of the best known as well as some of the hidden auto insurance savings.

- Drive Safe and Save – Drivers who don’t get into accidents can save up to 40% or more on their Buffalo auto insurance quote compared to accident prone drivers.

- Multiple Vehicles – Purchasing coverage when you have multiple cars on one policy qualifies for this discount.

- No Charge for an Accident – Not really a discount, but a handful of insurance companies permit an accident without raising rates as long as you don’t have any claims for a specific time period.

- Memberships – Affiliation with a qualifying organization may earn a discount when getting a Buffalo auto insurance quote.

- Distant Student – Kids living away from Buffalo attending college and do not have access to a covered vehicle could qualify for this discount.

- Service Members Pay Less – Being deployed in the military can result in better auto insurance rates.

- Accident Free – Insureds with no claims or accidents have much lower rates in comparison with bad drivers.

One last thing about discounts, many deductions do not apply to your bottom line cost. Most only cut the cost of specific coverages such as comp or med pay. So when it seems like you would end up receiving a 100% discount, companies wouldn’t make money that way.

A list of auto insurance companies and some of the premium reductions they offer can be read below.

- 21st Century has savings for driver training, homeowners, student driver, defensive driver, theft prevention, early bird, and teen driver.

- Progressive offers discounts for good student, homeowner, multi-policy, online quote discount, online signing, and continuous coverage.

- State Farm may have discounts that include defensive driving training, multiple autos, multiple policy, safe vehicle, good student, anti-theft, and driver’s education.

- Nationwide includes discounts for business or organization, good student, Farm Bureau membership, family plan, multi-policy, and easy pay.

- Esurance may offer discounts for multi-policy, defensive driver, online quote, homeowner, and anti-lock brakes.

- The Hartford offers discounts including vehicle fuel type, bundle, air bag, anti-theft, and driver training.

Before you buy a policy, ask all the companies which discounts you qualify for. Savings may not apply in Buffalo.

You may need specialized auto insurance coverage

Always keep in mind that when comparing the best auto insurance coverage for your vehicles, there really isn’t a cookie cutter policy. Everyone’s situation is unique and a cookie cutter policy won’t apply.

These are some specific questions could help you determine whether you may require specific advice.

- What should my uninsured motorist coverage limits be in New York?

- Am I covered when pulling a rental trailer?

- How does medical payments coverage work?

- Can I make deliveries for my home business?

- Is my custom stereo system covered?

- Does insurance cover tools stolen from my truck?

- How much underlying liability do I need for an umbrella policy?

- Is coverage enough to protect my assets?

- Do all my vehicles need collision coverage?

If you can’t answer these questions, you might consider talking to an agent. If you want to speak to an agent in your area, fill out this quick form or click here for a list of auto insurance companies in your area.

Compare rates but still have a neighborhood Buffalo auto insurance agent

Some people still like to talk to an insurance agent and that is a smart decision An additional benefit of comparing rate quotes online is the fact that drivers can get better rates but still work with a licensed agent.

After completing this form (opens in new window), your coverage information is immediately sent to participating agents in Buffalo that can give you free Buffalo auto insurance quotes for your insurance coverage. It’s much easier because you don’t need to contact an agency since rate quotes are delivered to you. You can find the lowest rates and a licensed agent to talk to. If you have a need to compare rates from a particular provider, feel free to search and find their rate quote page and submit a quote form there.

After completing this form (opens in new window), your coverage information is immediately sent to participating agents in Buffalo that can give you free Buffalo auto insurance quotes for your insurance coverage. It’s much easier because you don’t need to contact an agency since rate quotes are delivered to you. You can find the lowest rates and a licensed agent to talk to. If you have a need to compare rates from a particular provider, feel free to search and find their rate quote page and submit a quote form there.

Deciding on an provider should include more criteria than just a cheap quote. These are some questions you should get answers to.

- Are claim adjusters local or do you have to take your car somewhere else?

- Is coverage determined by price?

- How will an accident affect your rates?

- Is the coverage adequate for your vehicle?

- Which company do they place the most coverage with?

- Are all drivers listed on the coverage quote?

- Is the agency involved in supporting local community causes?

- Do they receive special compensation for putting your coverage with one company over another?

Shown below is a list of auto insurance companies in Buffalo that may be able to provide comparison quotes for Nissan Leaf insurance in Buffalo.

- The Decker Agency, Inc.

37 Elmwood Ave – Buffalo, NY 14201 – (716) 883-1455 – View Map - Kasprzyk Insurance Agency

497 Franklin St – Buffalo, NY 14202 – (716) 844-8178 – View Map - Dennis Evchich Agency Inc

826 Tonawanda St – Buffalo, NY 14207 – (716) 875-7576 – View Map - New Buffalo Insurance Agency, Inc.

14 E Tupper St – Buffalo, NY 14203 – (716) 332-1570 – View Map

After you get good responses to any questions you may have as well as a price you’re happy with, you may have found an provider that is reputable and can insure your vehicles. But keep in mind you can terminate your policy when you choose so don’t assume you’re contractually obligated to a specific company with no way out.

A little work can save a LOT of money

Throughout this article, we presented a lot of techniques to shop for Nissan Leaf insurance online. It’s most important to understand that the more price quotes you have, the better chance you’ll have of finding inexpensive Buffalo auto insurance quotes. You may even be surprised to find that the lowest prices come from the least-expected company. These smaller insurers may often insure only within specific states and give better rates than their larger competitors like Allstate, GEICO and Progressive.

Discount Nissan Leaf insurance in Buffalo is definitely available on the web as well as from independent agents in Buffalo, and you need to comparison shop both to get a complete price analysis. Some companies may not offer the ability to get a quote online and usually these regional carriers only sell coverage through local independent agents.

When getting Buffalo auto insurance quotes online, don’t be tempted to buy less coverage just to save a little money. In many cases, someone dropped collision coverage and found out when filing a claim that their decision to reduce coverage ended up costing them more. Your aim should be to buy the best coverage you can find at the best possible price while still protecting your assets.

More tips and info about auto insurance is located at these sites:

- What to do at the Scene of an Accident (Insurance Information Institute)

- What Car Insurance is Cheapest for a Mazda CX-7 in Buffalo? (FAQ)

- How Much is Buffalo Auto Insurance for Safe Drivers? (FAQ)

- How Much are Buffalo Car Insurance Quotes for a School Permit? (FAQ)

- Who Has Cheap Buffalo Car Insurance Rates for Young Drivers? (FAQ)

- What Insurance is Cheapest for a Nissan Altima in Buffalo? (FAQ)

- Who Has the Cheapest Buffalo Car Insurance for a Jeep Wrangler? (FAQ)

- How Much is Buffalo Car Insurance for a GMC Sierra? (FAQ)

- How Much is Buffalo Auto Insurance for a Hyundai Elantra? (FAQ)

- What is the Best Cheap Auto Insurance in Buffalo, NY? (FAQ)

- Teen Driver Statistics (Insurance Information Institute)

- Auto Insurance for Teen Drivers (Insurance Information Institute)

- Learn About Car Insurance (GEICO)